Savings Goals

Helping users build financial stability with simple savings goals—resulting in a 10% increase in monthly active users

— Company

Branch

— Timeline

4 months

— Tools used

Figma

Google Forms

— Project background

While working at Branch, I noticed a gap in our product: there was no integrated way for users to set aside money.

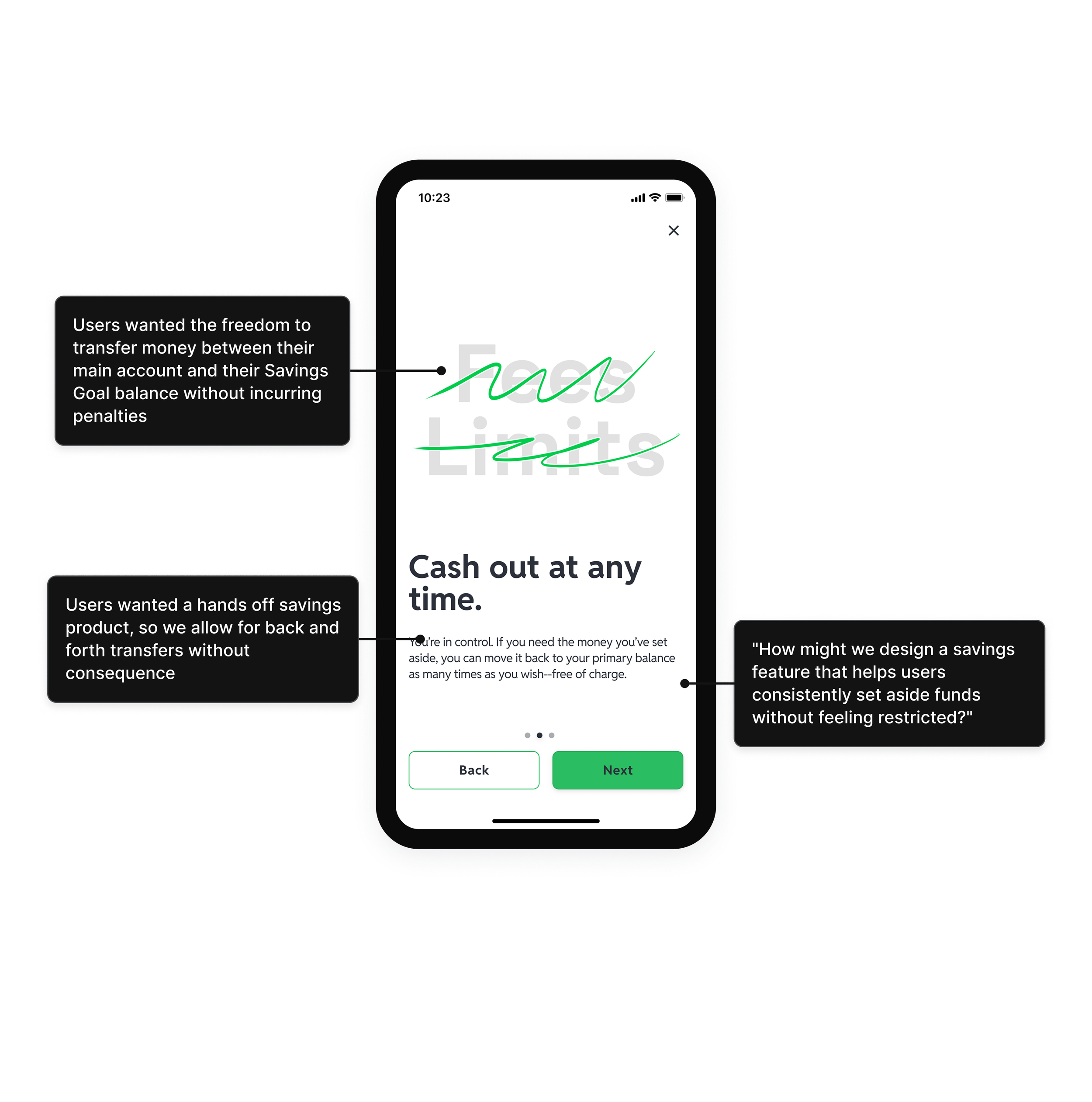

Partner research from Uber revealed that many drivers — especially 1099 and gig workers — wanted a way to save without friction. They needed flexibility to move money in and out freely, since savings often doubled as an emergency fund.

— The goal

We designed a simple, user-friendly savings experience by offering a dedicated savings balance, penalty-free transfers, and customizable savings goals. The primary goal was to empower users to easily set aside funds, creating a more stable financial experience. The solution focused on simplicity and user-friendliness, with a separate savings balance, flexible transfers with no penalties, and the ability to set savings goals.

How might we help Branch users build financial stability with a savings feature that feels flexible, intuitive, and empowering?

My role as the product designer

As the lead designer on this project, I led the end-to-end design process, with a strong focus on user needs and feature prioritization. My contributions included:

Partnering with Product, Engineering, and Uber’s research team

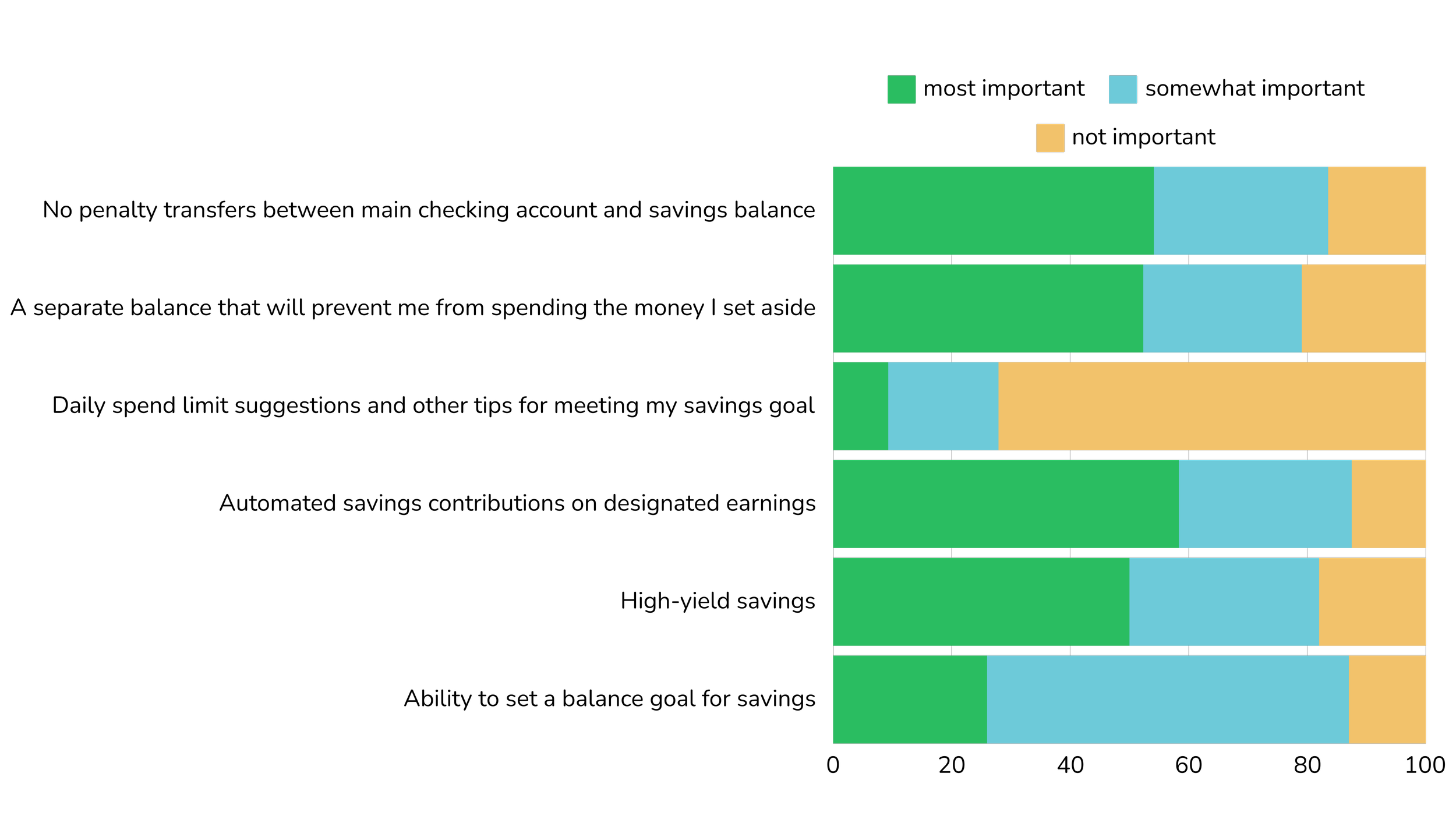

Defining the MVP based on user needs, technical feasibility, and speed to market

Designing the core flows, UI components, and visual patterns

Working closely with engineering through delivery to ensure design intent

MVP Features

Manual transfers – Save at your own pace, no lock-in

Dedicated savings balance – Funds feel “set aside” without being inaccessible

Simple goal creation – Name your goal, set a target, and track with a progress bar

Design approach

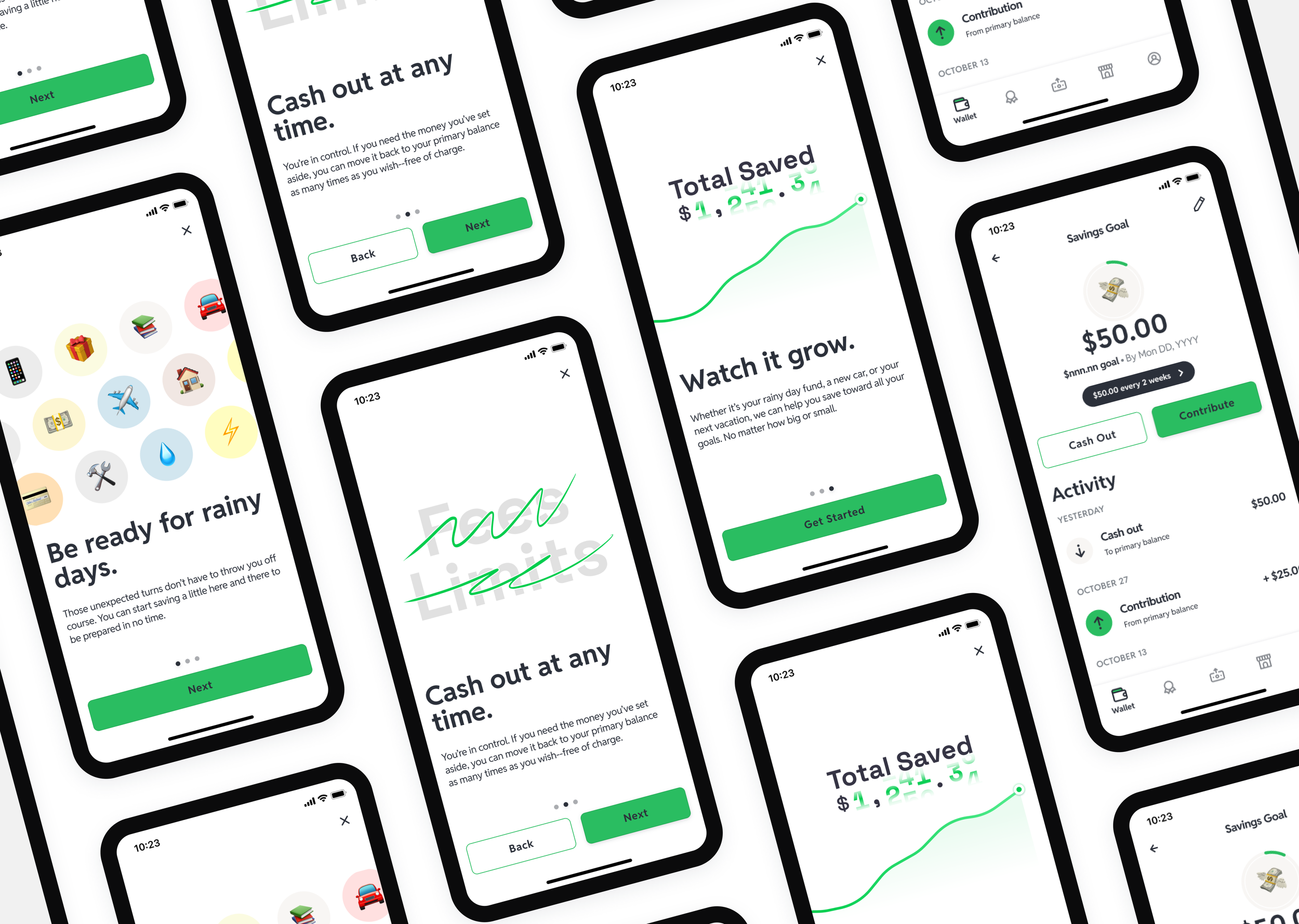

We focused on creating a clean, mobile-first experience:

Savings landing page showing balance and clear “Save Funds” action

Lightweight goal setup in 2–3 steps

Progress bar to visualize progress without feeling punitive

Seamless, no-fee transfers in and out of savings

Challenges

Balancing simplicity with flexibility

Preventing negative balance issues

Working within wallet technical constraints

Tradeoffs

Delayed automation & multiple goals to focus on a fast, usable MVP

Added withdrawal rules to protect users without blocking valid use

Collaborated closely with backend to adapt flows to existing architecture

Impact

In the first 4 weeks:

40% of users who tapped “Save Funds” created a goal

41% of those contributed funds

49% set a specific target amount

+10% monthly active users

–8% withdrawals from the primary account

Reflection

This project reinforced the value of:

Designing for trust, clarity, and flexibility in financial tools

Partnering effectively across organizations (Branch + Uber)

Shipping an MVP with measurable impact while setting the stage for future enhancements

Future Enhancements

Multiple concurrent goals

Round-up savings from card purchases

Detailed analytics for contributions vs. withdrawals