International transfers

Empowering global workers with seamless international transfers

— Company

Branch

— Timeline

2 months

— Tools Used

Figma

— Project background

Foreign-born workers make up a significant portion of Branch’s user base, many supporting family members abroad. Their existing options for sending money were slow, costly, and required leaving the Branch ecosystem.

We saw an opportunity to integrate MoneyGram’s API directly into the Branch Wallet — creating an in-app international cash pickup flow that prioritized speed, security, and trust.

For the MVP, we focused on Mexico-only transfers to move quickly, validate adoption, and minimize operational complexity.

— The goal

Design a simple, mobile-first cash pickup experience that allows users to send money abroad in just a few taps — without sacrificing trust, compliance, or usability.

How might we help Branch users send money to loved ones abroad—easily, affordably, and with confidence?

My role as the lead product designer

Led end-to-end design: from initial requirements through final UI delivery

Partnered closely with Product, engineering, compliance, and MoneyGram to align on scope and technical feasibility

Designed a mobile-first transfer flow optimized for speed and transparency

Balanced fraud prevention measures with a low-friction onboarding experience

MVP features

Integrated MoneyGram cash pickup – Initiate transfers directly from the Branch Wallet

Recipient setup in minutes – Add and save recipient details for quick repeat transfers

Transparent pricing – Upfront fees, exchange rates, and delivery times shown before confirmation

Real-time status tracking – See when funds are ready for pickup

Mexico-only launch – Focused rollout to test adoption and operational needs

Design approach

We designed for clarity and trust in a high-stakes financial flow:

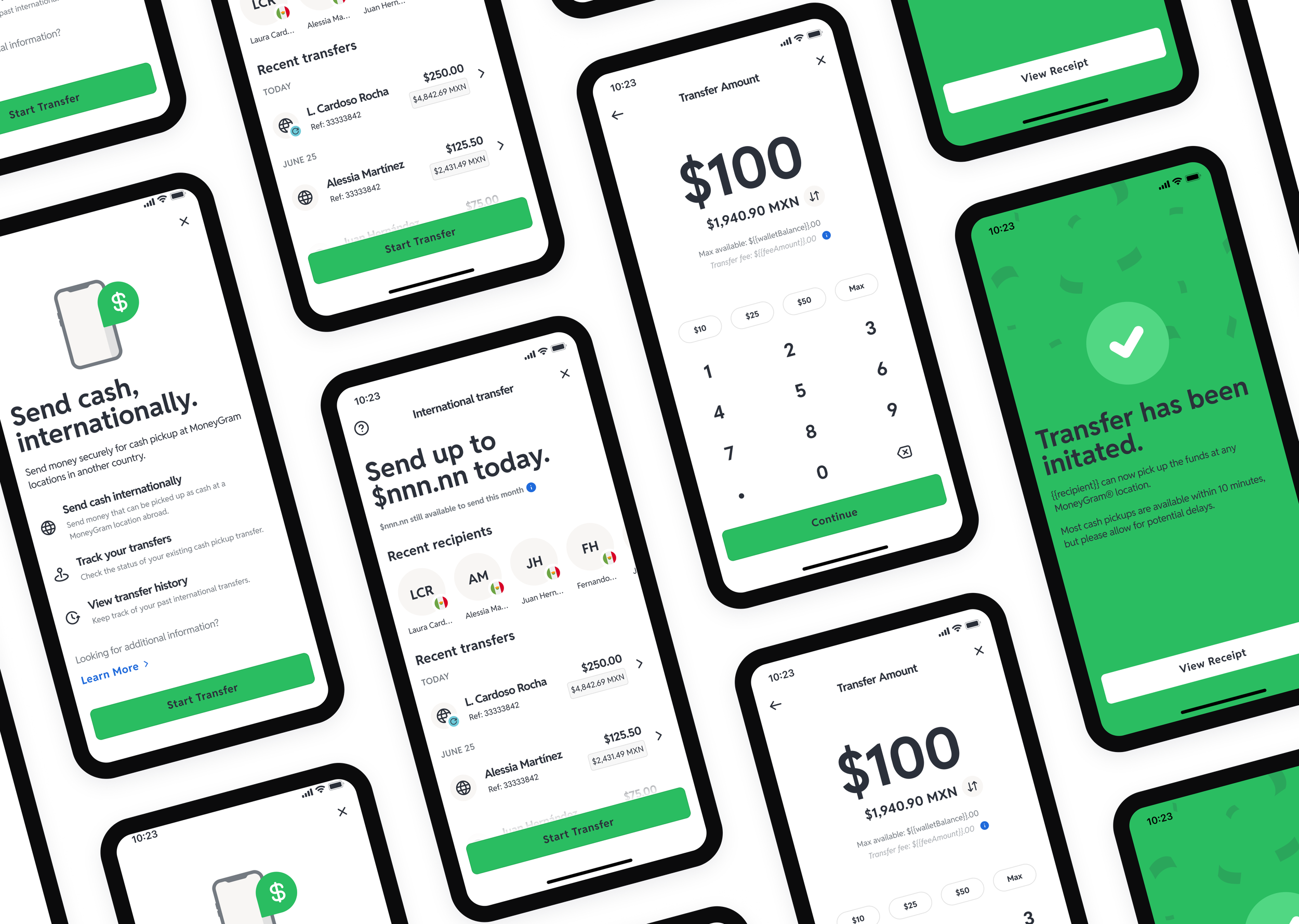

Streamlined steps – Condensed the experience into 3 main actions: select recipient → enter amount → review & send.

Visible security markers – Integrated MoneyGram branding, encryption icons, and delivery guarantees.

Progressive disclosure – Showed country-specific rules only when relevant to reduce cognitive load.

Mobile-first layouts – Optimized key screens for quick completion on the go.

Challenge

Fraud prevention vs. friction – Needed to keep transfers safe without making onboarding painful.

Speed to market – Goal was to launch quickly with minimal operational lift.

Compliance vs. usability – Regulatory requirements risked overloading the experience.

Solution

Designed lightweight identity verification and inline guidance to maintain security while keeping setup fast.

Limited MVP scope to Mexico-only cash pickup and optimized flows for rapid partner integration.

Collaborated with compliance early to design flows that met regulations without cluttering the UI.

Expected impact

This embedded international transfer feature is beyond convenience, it addressed a core life need for our users.

While we haven’t launched yet, we expect:

Empowered connections: Users could support loved ones without the friction, cost, or delay of legacy systems.

Greater financial stability: Users gained access to timely and trusted global payments.

Increased app usage: We anticipated higher retention and frequency of engagement as the Branch Wallet became more indispensable.

Competitive advantage: Branch offered a rare benefit in the paycard space: integrated, affordable remittance options. This project reinforces Branch's role as a trusted financial ally, continually adapting to meet the evolving and diverse needs of its user community.